Why do I need professional liability?

This policy is essential for anyone providing expertise or services. It protects you against costly mistakes.

Protect against claims of negligence

Even if you do everything right, a client can still accuse you of making a mistake, missing a deadline, or giving bad advice that led to financial loss.

Meet contract requirements

Many clients require proof of professional liability insurance before signing a contract.

Add a layer of professionalism and legitimacy

It’s seen as a sign that you're legit and prepared for professional responsibilities.

What's covered?

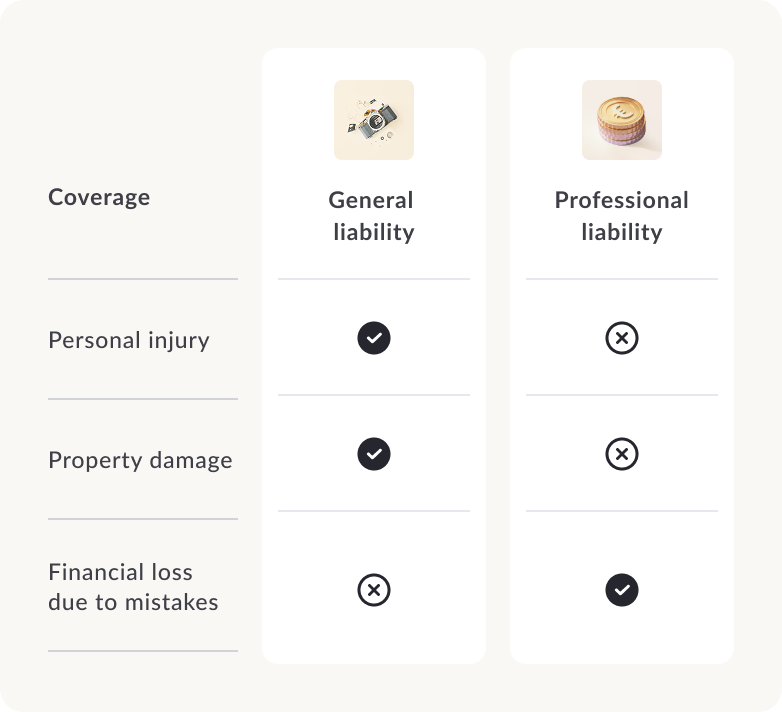

General vs professional liability insurance

General liability

It protects your business from third-party claims related to accidents resulting from your operations.

Professional liability

Covers financial losses due to professional mistakes. Professional liability is crucial for service-based businesses where errors or missed deadlines could lead to significant client losses.

When to use professional liability insurance?

Damage done by IT & tech freelancers

Missed deadlines or faulty code can cause clients financial damage—and lead to liability claims.

Example: A project runs late. The client claims lost business due to the delay and demands reimbursement.

Mistakes made by marketing & advertising freelancers

Delays, copyright violations, a wrong budget allocation to a campaign or poor advice can lead to legal disputes and financial claims.

Example: You publish a campaign using protected content. The rights holder sues, and your client demands compensation.

Business consultants

As a consultant, you face a high liability risk. If your advice causes financial harm, clients can demand compensation.

Example: You implement a new software system. Later, it's clear the solution doesn’t fit the client’s needs. They claim damages for lost time and revenue.

Ready to get covered?

Protect your professional self from costly mistakes.

Don’t take our word for it

Special deals

For those starting a new entrepreneurship and the ones looking for mid-term coverage.

Start-up discount

Was your businesses founded within the last 12 months? Get a 15% discount on your annual premium.

Term discount

Get a 10% discount on your annual premium, in case you choose in a contract term of 3 years or longer.