What is income protection insurance?

Income protection or disability insurance acts as an income buffer if you’re no longer able to work due to an unexpected occupational disability.

Disabilities covered by insurance have to cause a reduction in your capacity to work by at least 50% and have lasted more than 6 months. The most common disabilities are mental illnesses like burnout or coordination impairments like chronic back pain.

Public health insurance will pay for the first 6 months of an occupational disability, so getting income protection insurance can cover the gap until retirement or until you’re able to work again.

How does income protection insurance work?

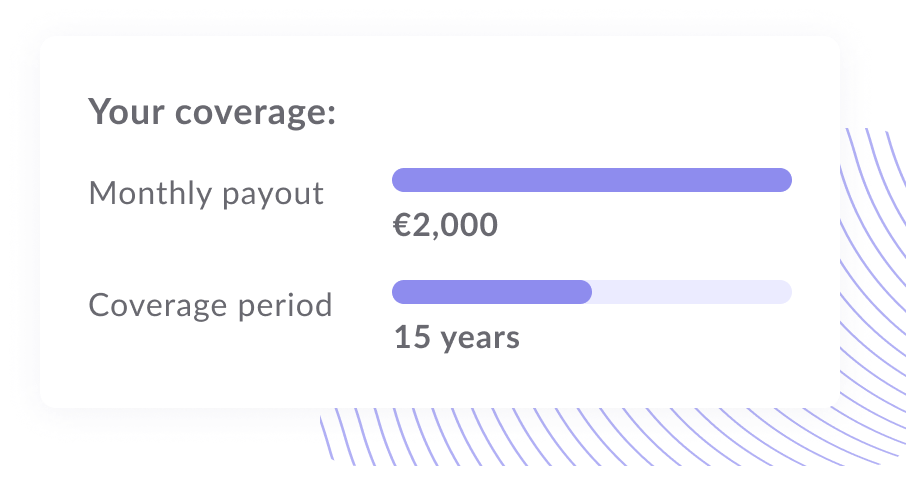

You’ll apply for insurance with a requested monthly payout sum. This is the amount you will get per month after it has been determined that you have an occupational disability.

Why do people need it?

Disabilities related to mental illnesses

Around 1 in 4 people in Germany experience a mental illness each year. Psychological health problems are the second most common reason for sick leave and the most common reason for early retirement. With the mental health add-on, your income protection insurance coverage would extend to psychosomatic occupational disabilities.

What’s not covered?

Performance-based unemployment

If you get fired or quit your job and are physically and mentally fit, then insurance will not cover this. It covers you if you are incapable of working to a certain extent and not because you wish to remain unemployed.

Short-term illnesses

Short-term illnesses like the flu or food poisoning that last about a week or a broken wrist that lasts 6 weeks are almost always covered under health insurance and your employer’s sick leave.

Occupations that aren’t covered

Certain dangerous occupations aren’t covered, like working with hazardous substances, in crisis areas, at a height of more than 10 meters, in aviation, in diving, in mountain sports, in martial arts, in motor sports, and in other high-risk fields.

Intentionally caused illnesses

Intentionally caused occupational disabilities are not covered (including self-harm and attempted suicide).

Want to know more?

You can get a personal quote or talk to us to learn more about the plan!

When you can use income protection insurance

Chronic back pain

Sam is currently working as a chef but is recently diagnosed with chronic back pain and told by her doctor that because of how physically demanding her job is, she’ll never be able to work in gastronomy again.

She receives her income protection insurance after the first 6 months. After that, she decides to go to a 5-month design boot camp and get a new job in another industry. She’ll continue paying her income protection insurance after her new employment begins.

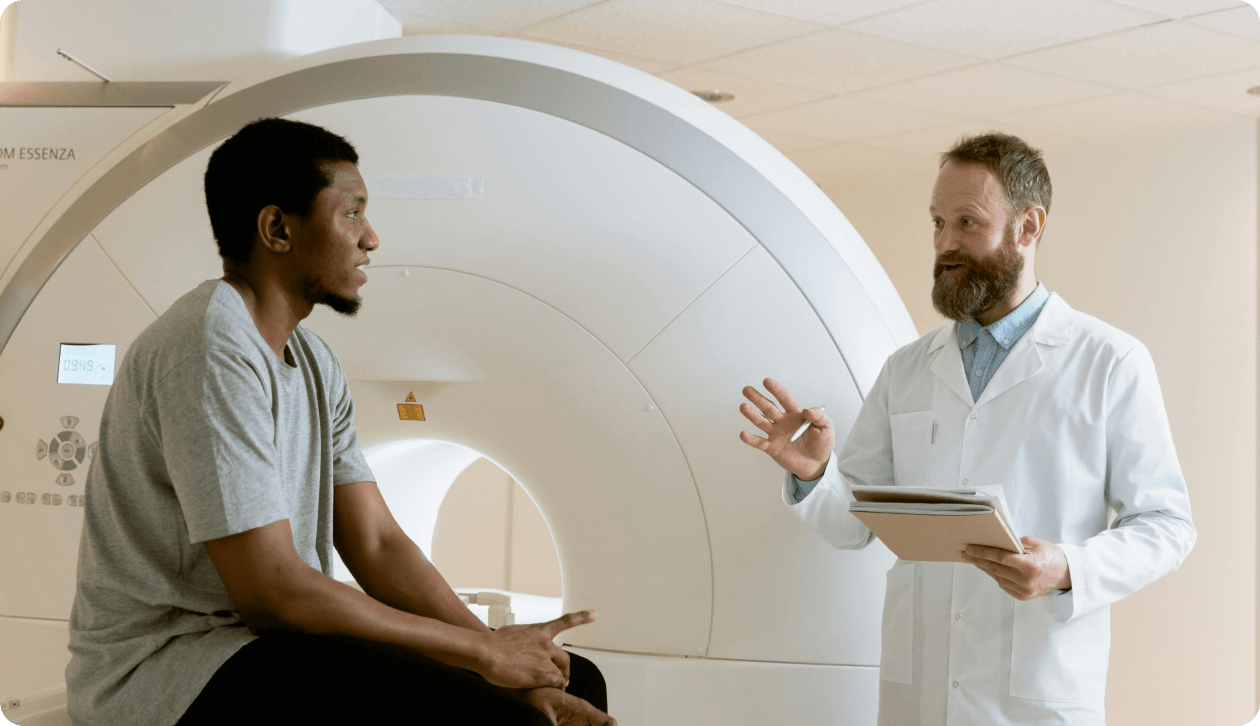

Cancer

Mark is diagnosed with thyroid cancer and needs to have his thyroid completely removed while taking medication and going through therapy to fight off the cancer. After 3 years, he feels well enough to continue his former work and continues to pay into income protection insurance at that point.

15% of the people who will receive income protection insurance will have cancer-related occupational disabilities. In this scenario, they will receive their monthly payout until they can work or retire.

Burnout

Mathias took on an internship in his dream industry where he worked upwards of 35 hours per week and studied simultaneously. It was exhausting, but he managed to get a good grade and graduate with a great start-up job.

He begins working upwards of 70 hours per week, while wearing multiple hats to ensure the company is successful. Four years later, the start-up, unfortunately, failed after an established foreign competitor joined the market.

The shock triggered his untreated burnout, and he became completely incapable of working or finding a new job. His doctor diagnosed him with long-term burnout, and now his disability insurance is the only source of income.

Frequently asked questions

How much will disability insurance provide in compensation?

How are benefits paid out?

Am I eligible?

Can I raise my compensation limit at another time?

What happens if I lose my job and am unable to pay?

Will I be denied disability insurance if I smoke?

How can I claim?

What is the difference between a concrete and abstract referral?

Wonder which insurance is best for you?

Try our recommendation tool for free to see which plans match your lifestyle.