We recently took a look at the German social security number (Sozialversicherungsnummer, SVNR), which is essentially your key to the country’s social security system. The SVNR serves as your main identifier in the German pension insurance (Deutsche Rentenversicherung) system.

So how does pension insurance work? Do you have to pay into the system if you’re not a German citizen? And what happens to your social security money if you leave Germany?

Regular contributions

If you’re a full-time employee, pension insurance will be deducted automatically from your monthly salary and paid to the national pension fund. Just as with public health insurance, the amount deducted for your pension is determined as a percentage based on your salary. If you are employed by a German company, your employer will pay half of this amount. The other half will be automatically deducted from your monthly paycheck. If you are a freelancer or self-employed, you must pay the entire amount on your own.

How much will I pay?

Depending on where you live in Germany, you will pay either 18.6% (in the former East German states, including the former East Berlin) or 18.7% (in the former West German states) of your salary into the national pension scheme. If you’re a high earner (lucky you!), then don’t fear—this number doesn’t keep going into oblivion. For 2020, the total contribution maxes out at €1200/month in the former East and €1283/month in the former West, based on respective “upper limit” monthly salaries of €6450 and €6900, respectively.

SOURCE: Deutsche Rentenversicherung

Need an example?

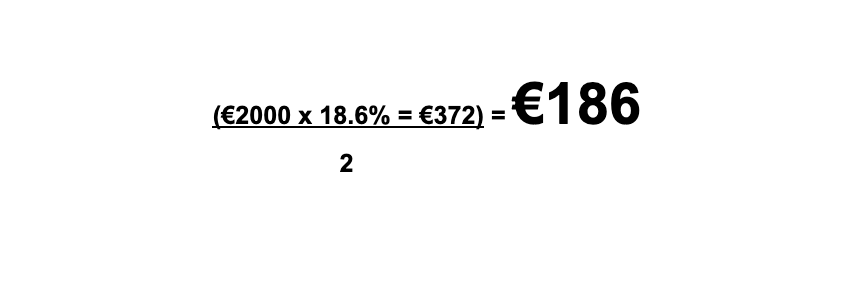

This means that if you’re employed in the former East Berlin earning €2000 a month before taxes, your monthly social security contribution will look something like this:

In this case, your total contribution is €372. Of that, €186 would come out of your paycheck and another €186 would be covered by your employer.

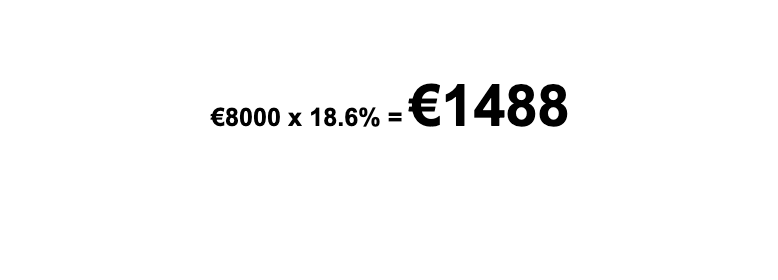

But what if you’re a freelancer in the same place earning €8000/month? Then your calculation would look pretty different.

Yes, that looks like a pretty big chunk of change—but remember, since you’re earning over the “upper limit” amount, your contribution stays at 18.6% of €6450. So your actual contribution will be €1999.70. (Still a big chunk of change but…not quite as big!)

Did you know? You may be able to claim exemption from social security payments with our private health insurance plan. Book an appointment to learn more.

What happens if I leave Germany?

Are you planning on staying in Germany forever? If not, all of these contributions to a social insurance scheme you may never benefit from probably seem like a waste of money. If you’re planning to move within the EU, then your social security contributions from Germany will be carried over to the country you settle in. You will have to contact the social security authority in that country to collect your funds.

But what if you’re not planning to stay in the EU? You may still be able to reap the benefits of your social security savings! Germany has entered into social security agreements with 20 countries. Generally, this means that you can transfer the social security funds you’ve saved in Germany to the social security authorities in those countries. If your country is on the list, you should check with your local social security administration to understand how to proceed.

What if my country doesn’t have a social security treaty?

Don’t see your country on the list? There’s still a chance of getting your contributions back. This can vary significantly depending on your situation, including how long you’ve been in Germany and where you choose to retire. We recommend getting in touch with Deutsche Rentenversicherung to discuss your specific case.

Thinking about insurance? Explore all of our plans below: